This post may be useful for everyone who thinks of their own business idea as well as for beginner VC investors. The ideas that I am going to talk about are taken from a book written by Peter Thiel called “Zero to One” as well as from my personal experience.

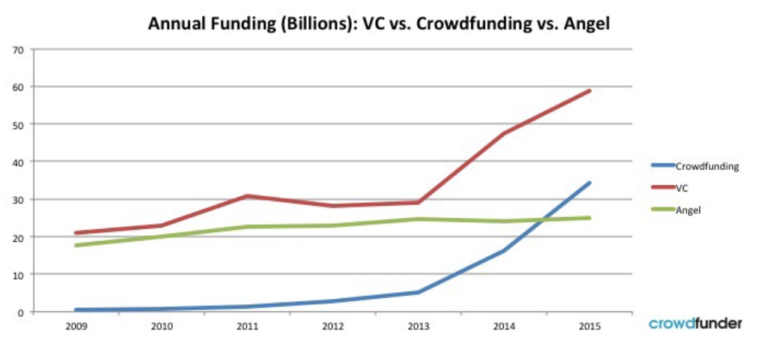

There are no many ways you can get enough funds to start your own company. I do not consider bank loans or support of your relatives here. Also, I assume that there are few people who can afford to run a startup from their own pocket. Said that we can see that there are only 3 ways you can get significant resources to start your IT business:

I treat venture investments and angel investments as almost the same. The only difference is that usually behind a VC there is a group of people, on the other hand, an angel investor is a single person. But crowdfunding is a completely another deal and you can see that it is growing significantly, thanks to cryptocurrencies and ICOs! However, ICOs and crowdfunding is not a part of this presentation, but I will share our experience and knowledge in that area in a separate talk or a blog post. Today we gonna talk about VC investments mostly.

But let’s start from the beginning. Everything starts with an idea. And most commonly, it fails at this stage :). As everybody knows, there is a secret behind every great idea – a truth that the majority doesn’t know.

One of the questions that Peter Thiel asks startup founders and his new employees is “What important truth do very few people agree with you on?”. It may sound like one of those nonsense questions that HRs ask you on interviews. But there is a deep sense in this question. Most often you will hear something like these:

But they are not secrets. These are obvious things or controversial topics for endless arguments.

And here are some good truths held by famous these days people:

The first one, obviously, belongs to PayPal founders. The second one belongs to Mark Zuckerberg. And the last one lies behind the idea of Amazon.

More about Leap of Faith Assumptions and Validating Ideas.

It is challenging to think of good secrets that are able to grow into a business because it makes you think of unpopular things. Everybody knows everything you learn at school or college. But a startup is an ideal tool to invent breakthrough technologies and new markets. You can convince a small group of people to follow your truth and try it out. On the other hand, it is more challenging to develop unpopular ideas in big companies, obviously, because the majority of people do not share them.

To get a venture investment, you need to understand how venture capitalists think. Serial investors understand how to make money and have a good understanding of how the economics works. Moreover, they understand some secrets, that the majority doesn’t know.

To go further we need to clear up one important thing. Let’s talk about monopolies. Are monopolies evil? You can hear from TV and read in newspapers that governments fight monopolies: they create new laws that restrict monopolies and try to fulfill their markets with competition. Let’s read the definition of “perfect competition” from Investopedia.

Perfect competition (opposite of monopoly) is a theoretical market structure in which the following criteria are met:

Sounds good for us as consumers, huh?

But let’s dive a bit deeper and discuss long-term effects of perfect competition and monopolies on an example that everybody knows: Google.

Is Google a monopoly? It is a tricky question.

Let’s consider Google as a search engine. It owns 70% of the market. When you talk with your friends and mean “search something on the internet” you say “Google”, which is an official term from Oxford dictionary. So, it owns the market completely and its brand name has become an official term for the whole industry. Does that mean that Google is a monopoly in the search engine market? Definitely, yes.

A tricky thing about monopolies: they do not call themselves monopolies and hide that. Because people hold negative stereotypes about all monopolies and treat them as something bad. We can consider Google as an advertising company because about 95% of its revenue comes from search advertising. In this case, we see that it holds only 3,5% of the global market, which is not much, in fact. Also, we can treat Google as a technology company and compare its revenue to the global IT market net worth. As you can see, it is a drop in the ocean.

Whether Google is a monopoly or not is a controversial question, but almost all their revenue comes from search advertising and about 70% of the search market belongs to them. However, they make a good job on hiding this.

Now, let’s go a bit deeper and talk about the ways of growth in economics. There are 2 ways of growth in economics: extensive and intensive. Briefly speaking, extensive way leads to a huge number of similar businesses that produce same product. It leads to a “perfect competition market”. On the other hand, extensive development usually caused by new processes or inventions. In the case of IT industry, it usually caused by new technologies.

Let’s stop here for a minute and think more. Let’s assume, that you own a business in a competitive market. It means that you run a company that is similar to hundreds of other companies. Also, it means that you fight for survival every day, trying to minimize your expenses and hold your prices competitive. Obviously, it means that you do not have resources to build long-term plans or invest into something new. You won’t be able to make a breakthrough in the technology world. At the same time new technologies lead to extensive development. New technologies matter more from global perspective than “perfect competition”. Only new technologies and extensive development lead to positive changes in our world.

And here an interesting conclusion comes: monopolies are more beneficial in long term. Only monopolies have enough resources to invest in new technologies and researches. Only monopolies can afford to pay their employees more and hire top talents. At the same time monopolies are able to earn huge money because they own entire markets.

Moreover, from the business perspective, building your business in a competitive market will now allow becoming different from the rest of the market and you can get stuck in competition with minimal profits.

Every investment is a huge risk because first of all you invest in people and humans are unpredictable creatures. As an investor, when you take this risk, your reward should not be 10x, but 1000x. It is logical, that only monopolies can give you such a growth.

I am sure you heard about some crazy investments. For example, there is a startup in Japan that is going to use the moon for advertising purposes. There was a huge hype around them when they raised their first millions. Now I understand the thinking behind such investments. If you are a serial investor and every investment is a huge risk, why won’t you splurge a couple of millions on the idea that can monopolize the moon?

But how investors distinguish monopolies among other businesses? Here are monopoly attributes formalized by Peter Thiel.

Apart from the monopoly attributes investors pay a lot of attention to the ability to generate cash flows. Here is a definition of cash flow from Investopedia:

Cash flow is the net amount of cash and cash-equivalents moving into and out of a business.

An important note here: please don’t mix cash flows with revenue or profit. Here are the definitions:

Revenue is the amount of money that a company actually receives during a specific period.

Profit is a financial benefit that is realized when the amount of revenue gained from a business activity exceeds the expenses, costs and taxes needed to sustain the activity.

Briefly speaking, a company’s revenue is the amount of money that the company receives w/o any deductions or expenses. Profit is the amount that remains after deduction of all expenses. But cash flow is related not only to money, but to its equivalents and also it can be negative, if a company has higher flows moving out of the business.

You may not have cash flows already, investors are looking for the ability to generate them in future. Also, please keep in your mind that the majority of IT startups are not profitable first couple of years and become profitable after 3-5 years. So don’t be afraid to reflect negative profitability in your business plan, experienced investors appreciate future cash flows more.

More about Startup Metrics.

One more thing investors pay attention to is durability. It comes from the previous point that IT startups bring profits to their investors after a couple of years. So here a logical question comes up: will your startup be able to survive until it becomes profitable and generates significant cash flows?

It is hard to predict, but it is closely connected with your initial idea and market. For example, if your startup is a trendy restaurant, it may be growing only until the trend is alive and most likely it will stuck in competition in long-term.

Now it is time for a quick summary. So, the ideal startup in the eyes of VC investors is a startup that:

I hope now you will better understand how VC investors think and based on this you will be able to evaluate how good your startup idea is.

Check the video version of the talk about raising money from VC.

Check out our newsletter